There is no clear end to the Sino-American trade conflict. Many companies cannot wait for the supply chain tariffing crises to abate. Seeking alternatives to China manufacturing a is sound and proactive option. Many supply chain leaders are in the process of analyzing risk/reward and have commenced new sourcing initiatives with other Asian countries. The challenge will be to analyze total landed costs weighing in freight, lead time, logistics, payment terms and cash flow.

The India Alternative

Economic reformation in India has set the stage for manufacturing innovations and a move towards contributing heavily to global supply chains. In such a market, India is more open to collaboration with the United States than some of its neighbors have been in recent years.

Is India the next China?

The economy in India has been proactive about internal manufacturing reform since 2014. That was when they passed the Make In India Act. Read this full disclosure. Make In India’s primary goal was to prepare the developing country to be a global marketing hub.

Pros and cons for India sourcing

The plan to pivot India to the top of manufacturing raises hopes and questions the heart of Asia. Some of the best outcomes would be as follows.

India

Pros:

- Labor costs would still be less for the hiring company.

- Rising wages and better jobs makes for a better economic environment in Asia.

- India would rise from developing status to first world status.

Cons:

The competitive advantages of India should be held with scrutiny.

- Delicate politics.

- Minimum wage may increase as a result for the workers in India.

- China countermoves to retain their power as a world leader.

- China Belt and Road projects influence over alternative ally countries

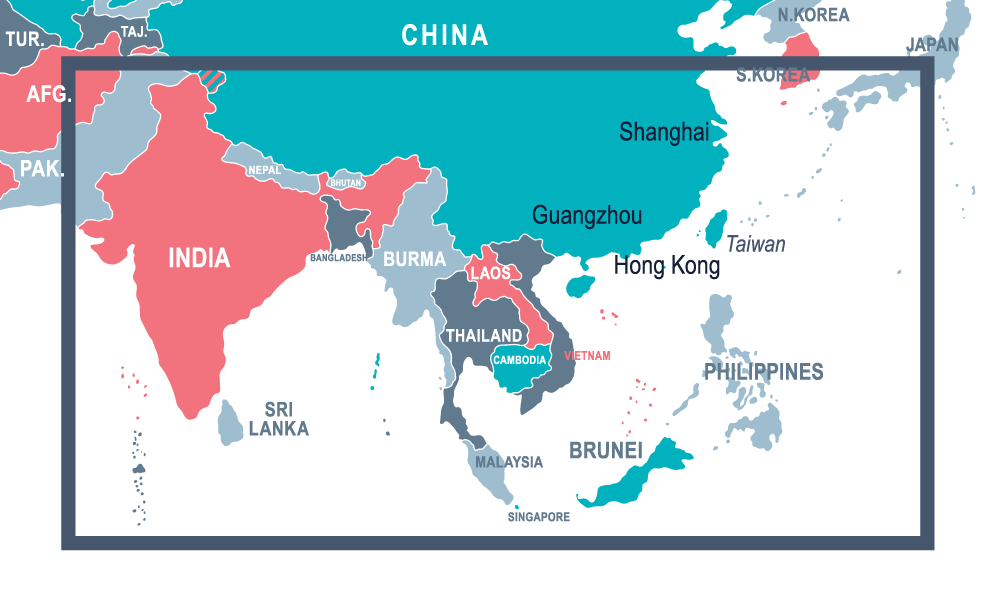

Southeast Asia Alternatives

In Southeast Asia, Vietnam, Taiwan and Thailand are each among the most highly developed in many aspects that gives them advantages many of their neighbors don’t yet have. They have the existing capacity to adapt quickly to Westernized workloads and competition. Infrastructure and Pacific ports exist to support transportation and logistics.

Stable governments and key positions in the trade cycle make all three of these countries highly attractive in terms of a relocation. You will still need to weigh countermeasures and consequences. It looks inviting but there are also disadvantages to plan around.

Pros and Cons of Southeast Asia

Making an accurate comparison for supply chain shift to the Southeast Asia block is tricky. There are more complex politics involved than with India.

Some of the Pros would include the following:

- An impetus for infrastructure renovations

- High tech revolution in rural lower Asia

- A better economy for the Pacific regions citizen demographics

Likewise, the small block Asian countries do not have the same luxury as India in terms of manufacture policy reforms. Some of these countries, like Cambodia, don’t yet have the infrastructure to support a mass exodus of China manufacture to their borders.

The China alternatives are found in the most developed Southeast Asian countries. The modern influence in Vietnam, Thailand and Taiwan make them the healthiest choices.

Pros and Cons for Vietnam, Thailand and Taiwan

Even though these three countries form the most logical sourcing agent solutions, they also have their limitations. Knowing the best and worst sourcing agent issues of each country will help your decision.

Vietnam

Pros:

- Saw a 16% manufacturing economic growth in August of 2018.

- Sees a “stellar” growth moving forward with economic activism in place.

- Vietnam is building a strong team of Foreign Direct Investors.

Cons

- Vietnam factories lack the experience in some industries that China/other countries have spent decades grooming.

- Vietnam has less access to raw materials than China.

- Vietnam’s population is much smaller than some of its alternative neighbors, making the labor force significantly less and the workload delay higher.

Thailand

Pros:

- Thailand is the hub of the ASEAN deal.

- Thailand has a world-class infrastructure with large scale WiFi access and 7 international airports.

- Is considered one of the most socially/politically stable regions of Southeast Asia.

Cons:

- The process for foreign business expansion is a complex paper trail.

- May be expensive, but hiring a personal Thai lawyer for a sourcing agent twist is advisable.

Taiwan

Pros:

- Robust economic growth is present. High tech is advancing. Taiwan was measured as the world’s 18th largest exporter in 2016.

Cons:

- Taiwan has a complex political history with China that may influence their decisions on America.

Making an informed transition plan

Whichever country you decide to defer your supply chain too, be mindful of one key thing. Your exit plan is as important as the savings you will make. The politics of the Pacific region are such now that a faulty exit plan can create shaky situations equal to the tariff problem.

Follow these principles when transferring your sourcing from China to an alternative country.

- Consult a China market relationship professional when possible to avoid an offense with existing trade partners.

- Consult a lawyer in the country you set up your sourcing alternative in.

- Reflect the cheapest labor wages against the superior experience and infrastructure of more developed countries in your selection base.

Should you pay attention to unique etiquette and these sensible practices your sourcing agency alternatives will yield a full investment return. You can rest assure that a Sino-American trade conflict doesn’t have to put your usual business on hold.

Follow Us